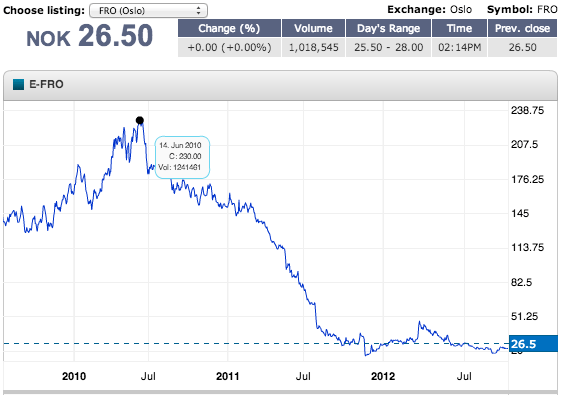

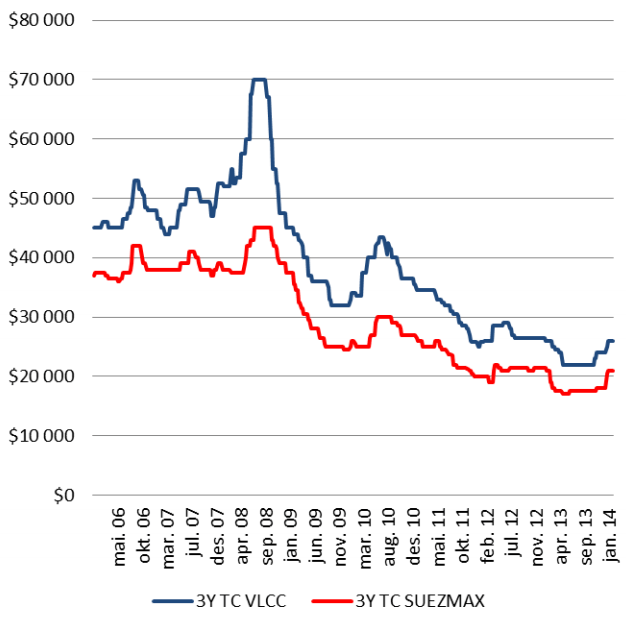

Image may be NSFW. For the world’s largest crude oil tanker company, 2013 was another year of losses. Frontline Tankers reported today their third yearly net loss in a row with negative results of $188.5 million. This figure is more than double the loss recorded in 2012 of $82.8 million and in 2011, the company recorded a loss of $529.6 million.Clik here to view.  Front Shanghai. Image (c) Frontline Front Shanghai. Image (c) Frontline2010 was the last time the company was profitable, but oddly enough, the company’s share price has more than doubled since November 2013 reaching NOK 26.5 on the Oslo stock exchange. Although this price not been seen since July 2012, this pales in comparison to mid-2010 highs above NOK 200. Image may be NSFW. Frontline reports average daily time charter equivalents (TCEs) earned in the spot and period market in the fourth quarter byClik here to view.  via Frontline via Frontlinethe Company’s VLCCs and Suezmax tankers were $22,400 and $12,900, respectively. These rates are still at historic lows for the crude tanker market as the following graphic shows. Image may be NSFW. Frontline notes that the supply/demand balance looking ahead is a very fine balance, “can easily be changed by increased fleet supply caused by increased ballast speed, decrease in vessel scrapping and aggressive newbuilding ordering.”Clik here to view.  Source: Clarksons Source: ClarksonsIn the company’s earnings call, CEO Jens Martin Jensen highlights this fine balance noting that an increase of vessel speed by 2 knots would equate to a virtual fleet increase of 10 percent. In addition, he notes that even with late 2013 improvements in the VLCC and Suezmax segments, the current slow-down in the LNG market as well as somewhat slower movement in the offshore sector could result in yard capacity opening up at Asian yards. This situation may result in an increase in orders for large crude tanker newbuilds. Current newbuilding prices for VLCCs and Suezmax vessels are around $97 million and $67 million, respectively. Frontline notes they have $1,058 million in debt obligations, and they note that the full repayment of that debt hinges “on a sustained improvement in tanker rates in the years to come.” Image may be NSFW. Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Clik here to view. Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  Image may be NSFW. Image may be NSFW.Clik here to view.  |

↧

Three Straight Years of Losses for Frontline Tankers

↧